Blog

In-Home Senior Caregiver — Employee vs. Independent Contractor

With the large aging portion of our country, hiring an in-home, private-duty senior caregiver has become very popular. In fact, it has also become one of the fastest-growing segments of the care industry. Part of this is due to the high cost of facility-based care. The other factor is the desire to enjoy the comfort and convenience of home. Quite often, the result is that you become a household employer and take on the responsibility of managing the caregiver, themselves.

If you decide to hire an in-home senior caregiver, you need to consider how they are classified. Many people believe that senior caregivers privately employed in the home can be classified as independent contractors, so that they may avoid paying payroll taxes. The IRS, however, has ruled that the vast majority of these caregivers should be classified as employees. Why? The family has the right to control how, what, when, where, or by whom the work should be performed. The number of hours do not matter. The amount of money that they are being paid does not matter. What they are called in the work agreement does not matter. In the eyes of the IRS, if you misclassify a household employee as an independent contractor, you could be charged with tax evasion. When paying for a caregiver to care of your loved one, the last thing that you want to worry about is being charged with tax evasion.

If you or your family employs a caregiver, there are some tax breaks that can significantly offset the employer payroll taxes. The tax breaks that are available to most families with caregiver needs are:

- Dependent Care Account (a type of Flexible Spending Account)

- Dependent Care Tax credit (Form 2441)

- Medical Flexible Spending Account (for medical care)

- Medical Care Tax Deduction (Schedule A – Itemized deduction for qualifying medical expenses)

The caveat with most tax breaks and rules, however, is that there are notes, criteria, and exceptions.

Making the decision between facility-based care and in-home care is not necessarily an easy one. Your trusted advisor/CPA can help you understand what solutions work best for you. They can create budgets so that you can see the various financial impacts so that you can make a decision that is best for your situation. Your circumstances may even qualify for assistance under a LTC plan or a government program.

-Michael Hermanson, CPA | CGMA

New IRS Ruling Will Help Identify More Profit-Shifting Tax Havens

On June 30, 2016 the U.S. Treasury and the IRS finalized and issued a ruling, which requires U.S. parent companies of large multinational public and private companies to provide financial data to the IRS on a country-by-country basis. This is intended to provide information to tax authorities (world-wide) so that they will have the ability to identify where companies may be shifting profits into tax havens. This will most likely initiate additional investigation as this is a sign of possible tax avoidance.

The U.S., along with other countries that are part of the Organization for Economic Cooperation and Development (OECD), made a commitment (last year) to adopt country-by-country reporting. This rule solidifies that commitment. The headquarters of the OECD is in France. However, the U.S.-based multinational companies will be required to provide their financial information to the IRS. The U.S. government will then make that information available to tax authorities in other countries where these companies have subsidiaries.

The OECD has an initiative, which is meant to discourage these multinational companies from artificially moving profits to low-tax countries. This initiative is called Base Erosion and Profit Shifting. The country-by-country reporting was included in Action 13, which is part of the 15-point BEPS Action Plan. The final regulations apply to taxable years beginning on or after June 30, 2016. Taxpayers that are affected should not wait to begin their preparation for the new requirements.

Action 13 does not make the country-by-country reporting available for public consumption, though, which had been requested so that Congress would have access to the information to ensure that they are crafting effective tax laws as they look to reform the U.S. tax code. There are a number of proposed law changes, which have been presented for consideration. Providing them more information on a subject that many of them already cannot agree upon seems to be misguided, at this point. This information may be more relevant after January 20, 2017.

Whether or not you agree with this rule, we are part of a global economy. Technology has made the world a much smaller place. We literally have access to all sorts of information at our fingertips. This is another step in attempting to level the playing field for many companies. It is also a major step for taxing authorities to receive their fair share of the global business profits. We obviously still have a long way to go. The recent Panama Papers’ situation shows that. The response from these companies will be eye-opening for the world. Will they decide to continue to expand or will they shut down subsidiaries? Will the executives take more compensation or will they invest back into their companies and their employees? Will workforce continue to be moved? Time will tell. Hindsight will give us all perfect vision.

-Michael Hermanson, CPA | CGMA

How Will The BREXIT Vote Affect Your Retirement Accounts

Imagine that you have been planning your vacation for months. After some routine maintenance, you pick up your vehicle from your local service garage. You load up your family in the car and start driving to your destination. Then, 200 miles from home, your oil light comes on. You continue to drive, but then your engine light comes on. You continue to drive while wondering what could be wrong. Suddenly, your engine seizes up and your vehicle stops in its tracks. How do you react? Do get your family out of the car and start walking home? Do you panic and start yelling at your car? Or did you plan ahead and purchase something like AAA Insurance to help you in times of need?

It should not be the situation that dictates your response, but what you have done in preparation for dealing with situations that present themselves. With that said, we should realize that we do not live or plan in a vacuum. We cannot control everything. Outside influences will have an effect on us, both man-made and natural. When possible, we should adapt, adjust, and respond, rather than simply react. Reactions can have negative results in the short term and the long term. However, in any given circumstance, sometimes a reaction is the only option we have.

In the case of the BREXIT vote, there was knowledge of the potential vote. Some investors reacted to the potentials by selling off a number of shares that they thought might be affected. Some did so immediately after the vote. Why? They panicked. They took a short-term view. They did not understand the full impact of the vote. What did this accomplish? They helped to cause additional panic, world-wide. The global markets hemorrhaged more than $2 Trillion in paper wealth. This was the worst sell-off since September of 2008. These types of reactions affect everybody.

What should we do when these types of events are coming up or have occurred? The best advice that I can give you is to stay the course. Be thoughtful with your decisions. Your retirement plan is a long-term plan and your choices along the way may effect multiple lives. There will be highs and lows on your journey. Maybe a better frame of mind would be to think about it as ebbs and flows. You can’t stop the tide from coming in or going out, but you can work with the power of the water instead of against it.

Will the Brexit vote adversely affect the value of your retirement portfolio? It will most likely have some effect. The extent is yet to be fully determined. A number of factors will go into answering that. What is your risk tolerance? Where are your investments? How aggressive is your portfolio? What type of return are you looking for? How diversified is your portfolio? You do not simply answer these questions once and then forget about them. As events in your life and the world happen and unfold, you adjust your retirement plan as needed, to keep your boat afloat. Having access to your financial advisor/professional at times like this is very important. They can help you to steady your course and smooth your seas.

It may take five years or more to discern the ramifications of the UK’s departure from the EU. However, the reactions of individuals, businesses, governments, and other countries (in the meantime) could either enhance, diffuse, or completely change the direction of the current track. Step back, take a deep breath, seek the advice of professionals, and step forward with purpose. Retirement may be tomorrow for some and a lifetime away for others. Whichever it is, be motivated today to celebrate now and in the future through patience, understanding, and planning.

-Michael Hermanson, CPA | CGMA

IRS Provides Tax Relief to Houston Area Storm Victims

IRS Provides Tax Relief to Houston Area Storm Victims; Tax Deadline Extended to Sept. 1

The Internal Revenue Service announced today that the Texas storm victims, including those in the Houston area, will have until Sept. 1, 2016 to file their returns and pay any taxes due. Additionally, all workers assisting with the relief activities, who are affiliated with a recognized government or philanthropic organization, will also qualify for relief.

Following this week’s disaster declaration for individual assistance issued by the Federal Emergency Management Agency (FEMA), the IRS said that affected taxpayers in Fayette, Grimes, Harris and Parker counties will receive this and other special tax relief.

The tax relief postpones various tax filing and payment deadlines that occurred starting on April 17, 2016. As a result, affected individuals and businesses will have until Sept. 1, 2016 to file their returns and pay any taxes due. This includes 2015 income tax returns normally due on April 18, 2016. It also includes the 2016 deadlines of April 18 and June 15, for making quarterly estimated tax payments. A variety of business tax deadlines are also affected including the May 2 and Aug. 1 deadlines for quarterly payroll and excise tax returns. In addition, the IRS is waiving late-deposit penalties for federal payroll and excise tax deposits normally due on or after April 17 and before May 2 if the deposits are made by May 2, 2016. Details on available relief can be found on the disaster relief page on IRS.gov.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. Thus, taxpayers need not contact the IRS to get this relief. However, if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated.

In addition, the IRS will work with any taxpayer who lives outside the disaster area but whose records necessary to meet a deadline occurring during the postponement period are located in the affected area. Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS at 866-562-5227.

Individuals and businesses who suffered uninsured or unreimbursed disaster-related losses can choose to claim them on either the return for the year the loss occurred (the 2016 return normally filed in early 2017), or on an original or amended return for the prior year—tax year 2015 in this situation. See Publication 547 for details. The tax relief is part of a coordinated federal response to the damage caused by severe storms and flooding and is based on local damage assessments by FEMA. For information on disaster recovery, visit disasterassistance.gov.

The State of Texas does not collect state income tax from individuals. For other questions about other Texas taxes, please visit http://comptroller.texas.gov/.

-Michael Hermanson, CPA | CGMA

Saving Can Be Easy...If You Put Your Mind To It

For some, the word “saving” is like a curse word. It somehow means that you cannot spend your money on “fun” things now, or it somehow means that you have to give up all opportunities until you are older. It does not have to be this way. You can have fun now and in the future. All it takes is some planning and some self-control.

I suppose that if I am using words like “planning” and “self-control”, I should also throw the word “budget” out there, as well. This does not mean that you can’t be spontaneous. It will, however, help you to be more thoughtful about your approach to your financial future. And…your financial future will affect almost every other aspect of your life.

So how do you start? Well, some parents start saving for their kids at a very young age. The problem is, they don’t tell their children what they are doing, why they are doing it, and how it will help them. If your parents did not do this or were not in a position to start this for you, then simply make the decision to begin the process of setting aside money on a weekly, bi-weekly, or monthly basis. You can start with a savings account. As your financial literacy grows, you may want to venture out into other financial options, which would allow your money to work harder for you. It is never too late to start saving.

Are you an employee? Does your employer offer a 401 or 403 retirement option? Do they match contributions? Is there a profit sharing option? Take advantage of these employer contribution components. If they do match, go for the maximum. Your contributions will help out on taxes. Your pre-tax dollars will go in and not be taxed until being withdrawn at retirement.

Maybe an IRA would be a better option for you. Your contributions have limits, but they may also be deductible. There are, however, phase-out thresholds for your contributions. Don’t let these limitations deter you from using these types of financial instruments. They are helpful and will help you to reach your goals. The biggest drawback with IRA’s is when you withdraw funds before age 59 ½. There is a 10% penalty for early withdrawal. That is why having a savings account as a reserve for those unexpected situations is a great complement to the IRA. There is also a 50% penalty for failing to start taking traditional IRA withdrawals after age 70 ½.

|

|

|

Contact us today. We will help you understand how to save and grow your money! |

There are also people that like to do their own investing and that is perfectly fine. If you take this route, I encourage you to do your homework. Look at various avenues for your investments. Avoid “high cost” funds. Your money may end up working to pay the fees and not growing for your future.

Your tax refund is another great opportunity for saving money. Some people have their refund money spent before they get the funds. If you think of your refund as income, you may potentially lose out on a reserve funding source. You could take your refund and put it into savings, your 401/403 account, or use it as an IRA contribution. An out-of-sight, out-of-mind approach can help to keep money from burning a hole in your pocket.

With all of this said, I realize that everyone’s situation is different and that we all do not have the same options. However, the approach here is meant to cover most people. Many of us having financial concerns for the present and the future. I think that we would all like to retire someday. That is why it is so important to take advantage of the present to make sure that we can be prepared for the future. Don’t plan on a luxurious retirement. Plan on a comfortable retirement.

-Michael Hermanson, CPA | CGMA

The CPA and CGMA Credentials and How They Can Help Your Business

A Combination of Accounting, Finance & Strategic Insight

CGMA (Chartered Global Management Accountant) is the global version of the CMA (Certified Management Accountant). The CGMA designation recognizes the unique competencies and skills of management accountants, who combine accounting and financial knowledge with strategic insight. The designation indicates that the CGMA holder has management accounting expertise in areas such as: leading strategically to make more informed decisions; helping organizations manage change, risk and uncertainty; protecting corporate assets; and promoting operational efficiency and effectiveness. While CGMA designation holders are primarily found in business, industry, and academia, they may also work in CPA firms.

Financial Accounting is a specialized branch of accounting that keeps track of a company's financial transactions. Using standardized guidelines, the transactions are recorded, summarized, and presented in a financial report or financial statement such as an income statement or a balance sheet.

Management Accounting, on the other hand, deals with the use of accounting information by managers within an organization. Management accounting provides managers with necessary information to make informed business decisions. Management accounting is essential for an organization to be better equipped and to control functions.

Management accounting information differs from financial accountancy information in several ways:

Ø while shareholders, creditors, and public regulators use publicly reported financial accountancy information, only managers within the organization use the normally confidential management accounting information.

Ø while financial accountancy information is historical, management accounting information is primarily forward-looking.

Ø while financial accountancy information is case-based, management accounting information is model-based with a degree of abstraction in order to support generic decision making.

Ø while financial accountancy information is computed by reference to general financial accounting standards, management accounting information is computed by reference to the needs of managers, often using management information systems.

Key point here is that a CPA and a CGMA offer both financial and management accounting and can provide the overall picture that a company needs to thrive.

-Michael Hermanson, CPA | CGMA

Should you use a credit card for your small business?

Small Business Credit Card Usage For Expenses & Revenue

Should you use a credit card for your small business?

It really depends upon your situation. Are you using it because it is convenient? Do you not like carrying your checkbook around? Many businesses actually prefer that you use plastic, as opposed to writing a check, when buying from them. This is fine, as long as you keep tabs on your spending. If left unchecked, you could rack up a large balance in no time. Will you have the reserves to pay off your CC statement? Will you try to obtain a loan to pay off the balance and then end up owing the financial institution, instead? It can be a vicious cycle and it could cause you to shut down your business. However, by using a budget and a fair amount of self-control, your CC can be (and should be) a beneficial tool in your business. Start slow. Sometimes it’s the small steps that will form the healthy money/spending habits. Also, asking for help on how to control your spending habits can help in the short and long term.

Changes to credit card usage in 2015.

Starting October 1, 2015, business that have the EVM (Euro-pay, MasterCard, and Visa) chip enabled terminal(s), will have additional protections from counterfeit credit and debit card fraud. However, each business will have to decide whether or not to invest in the new equipment. For a company that processes a large volume of card transactions, it is really a must. For those that have a relatively small number of card transactions, you will want to weigh the cost of the new equipment against the risk of not getting the new equipment. However, if you do not, your business could become legally and financially responsible for counterfeit and fraud conducted in your stores. With this technology in place, your business will still need to be PCI-compliant under payment card industry regulations. If you have a data breach and it is due to the lack of compliance with the EMV and PCI standards, your business could also face fines, penalties, and termination of the right to accept card payments. There is still time to decide on how you would like to proceed, but now is the time to start talking about it.

-Michael Hermanson, CPA | CGMA

How To Take Advantage Of The Business Metrics To Help Your Business Succeed

A business metric is defined as a quantifiable measure that is used to track and assess a business process/activity. They help give you better vision into your company and provide a better framework for making better decisions. While some owners and managers prefer the use of gut instinct or merely flying by the seat of their pants, business metrics are more grounded in reality. The metrics are used to assess what has happened and what is happening. They are also used to make better decisions about what will/could happen. Unfortunately, many business owners do not know where to start to take advantage of these metrics. Of note, business metrics are not to be confused with KPI’s.

If you are using any kind of software to track your business activities, you are already collecting data. This could include accounting software, spreadsheet software like Excel, POS software, time-tracking software, an inventory module add-in, or any other program. Many people, however, only look at quick/easily available/tertiary outputs from a program. It is an approach of seeing what you need to see in order to survive. As a CPA, some of the questions that I am asked are…Where is the information? What do I do with it? Can you help me make sense of this? Can you help me get the information that I want? Can you help me to define what information I need/want? The data is often there. You need to pull the data into a usable format, which is called information. You then analyze the data to produce your metrics.

For many, getting from Point A to Point B is where they get lost. There are a few things to consider, when thinking about your business metrics.

First, define your business goals. These could be something like annual sales of $5M, have a profit margin of 15%, increase new customers by 7%, and the like. If you do not know where you want to be, there really aren’t any metrics that can truly help.

Second, define and design the most important metrics for your business, but keep in mind that too many metrics will create more noise and less clarity.

Next, some metrics are comparisons so you will need to benchmark your business processes/activities. That way, you can see whether or not a specific activity is efficient, whether or not it profitable, whether or not other opportunities are available, etc.

You will also need to implement a process/system/control so that you may monitor and report your business metrics. Coupled with this, you need to review and evaluate/analyze the results. Are things better, worse, or no change? Do we need to change or tweak the process? What can we do to improve? Do we need to approach something differently? Are we operating at optimal performance? Engage in the next cycle.

Communication is the overarching theme in this whole process. Discuss the metrics with your employees and get them engaged. Tell them that the metrics are there and what they are intended to accomplish. Let them know that metrics are used to evaluate business activities and that includes the concept of individual and/or group accountability. Make sure that they fully understand and that you do not create undo anxiety. If the metrics show success, then promote that success. If rewarding individuals/groups/departments is order, then do so. If the results are negative, make sure that the metric was not poorly designed, then talk to the individuals that need improvements.

Getting started is always the most difficult step. You can look at or talk to other similar businesses. What do they measure and why? You can research the Internet. You can also talk to a CPA. They will have a breadth of knowledge to help you sort through all of this. Having the experience of working with a number of different clients in a number of industries provides the CPA with a wealth of opportunities to approach every situation from many angles. Metrics that work for a manufacturing company may not work for a services based company. However, there are some similarities around the costs of doing business and the CPA can often apply synergies between all clients.

-Michael Hermanson, CPA | CGMA

Fraud Prevention Tips for Nonprofit Organizations

Last week, a woman from Stoughton, Wisconsin was arrested for embezzling $86K from a nonprofit booster club’s financial accounts. “A treasurer of the Stoughton Wrestling Booster Club was arrested for allegedly draining the club's financial accounts and taking more than $270,000 from a vulnerable adult living in Stoughton, according to a release from the Stoughton Police Department.” (“Treasurer steals $86K from Stoughton wrestling booster club”)

As a CPA, I find this happens all too often.

So what should nonprofits do to lessen the chances of this happening?

There are two important points that need to be addressed. First, businesses/entities need internal controls in place, regardless of whether they are for profit, non-profit or government. Secondly, these controls need to be enforced (monitored, evaluated, and taking corrective action, as needed). The most vulnerable groups have been the smaller non-profits and individuals. Unfortunately, those that would/will take advantage of that, also know this. I have seen a number of smaller non-profits that either do not have adequate internal controls in place or they do not enforce them. This is providing an opportunity for someone to take advantage of a situation.

What are some things that can be done to help prevent this?

If someone is coming in to “take care of the books”, ask for qualifications and references. Is this person a friend, an acquaintance, or neither? Call their references, check on their work ethic and their character. Be sure that the individual has accounting or bookkeeping experience. In talking with them, discuss what they do for a living and why they want to help the non-profit. This will give you some insight into their intentions, their outlook, and possibly some financial pressures that they may have. If you decide to bring them in, provide them with the set of duties and set of ground rules. Let them know who they will report to, what is expected, and what reports and work papers they will need to produce. Also, let them know what controls are in place, such as a board member needs to sign for any transfers out of the savings account. As a board (or board member), you will want to vet their work. Look at the bank statements. Review the cash inflows and outflows. Does everything look right? If you know an accountant that may want to donate some time, have them review your financial information. They may see something that you do not.

As long as there is accountability and regular oversight and review, this will help prevent a number of potential problems. Remember, these people do not just hurt the organization, but all of the people who are helped by the non-profit. As for individuals, trusted friends and family should be able to help. You can also consult with other professionals. One of the best things that you can do is to trust your gut instinct. If something looks or sounds fishy…it probably is. And don’t be bullied. You have the right to say slow down, wait, and no.

-Michael Hermanson, CPA | CGMA

The Affordable Care Act and Your Individual Tax Return - What You Need To Know

The Affordable Care Act and Your Individual Tax Return

The Affordable Care Act (ACA) was signed into law on March 23, 2010. The primary goal was to reduce the overall cost of health care, while ensuring quality of care by reducing the gaps and aligning financial incentives among physicians, hospitals, and other health care services providers. These incentives are based on quality, efficiency, and expense control.

Beginning with the 2014 tax year, tax payers may have some extra forms to complete when completing their 2014 Federal Income Tax Returns. It is estimated that 75% of individuals and families will simply be able to click a box showing that they had non-marketplace heath care coverage for all of 2014. These include:

- Most job-based plans, including retiree plans and COBRA coverage

- Medicare Part A or Part C

- Medicaid

- The Children’s Health Insurance Program (CHIP).

- Most individual plans purchased outside the Marketplace, including “grandfathered” plans. However, not all plans outside the Marketplace qualify as “minimum essential coverage”

- VA or TRICARE

For individuals and families who had a health plan through the Health Insurance Marketplace (Marketplace), there is additional effort that is required. To help with the tax filing process, all Marketplace consumers will receive a Form 1095-A, which is a new statement. In many states, this form can also be downloaded. As with any new form, you will want to review the form for accuracy. It is important to wait until you receive your Form 1095-A before filing your taxes. It includes all of the information you will need about your coverage in order to file your return.

There are, however, some additional forms that will need to be completed and filed with your return. It can be overwhelming for some, who may want some guidance from a professional. Here are some additional basics:

If a tax credit lowered your monthly premiums for health insurance coverage in 2014, you will use the information from your Form 1095-A to enter into these forms when preparing your taxes. You had estimated your household income when applying for your credit. You will need to compare your estimate with your actuals. If there was a change in household income or household size, your tax credit may be impacted. Your refund may be less, or more, or you may owe.

If your coverage from the Marketplace began partway through 2014 and you were uninsured earlier in the year, or if you were uninsured for only a short period of time during 2014, you may be eligible for an exemption from the requirement to have health coverage.

For individuals and families that did not have health coverage in 2014, who could afford coverage, but chose not to and you don’t qualify for an exemption, you may have to pay a fine. The fee is based on your income and the number of months in which you did not have coverage. If you didn’t have health coverage for all of 2014, you will pay the higher of $95 per adult and $47.50 per child, who didn’t have coverage, limited to a family maximum of $285, or 1% of your income, subject to certain caps.

Individuals and families that could not afford coverage or met other conditions can receive an exemption. If you qualify, you need to take the necessary steps to request the exemption. A couple of the exemptions available are 1) The cost of the coverage was too expensive and 2) You experienced a hardship.

Now, this is a lot to digest, but it is now part of what we have to do. Only time will tell if the benefits outweigh the costs.

-Michael Hermanson, CPA | CGMA

Tax Return Checklist

Whether you are preparing your own income tax returns or you go to a professional, here is a laundry list of items to review before you actually begin your return. Now, the list that follows is rather lengthy, but important. For many people, they will only have a few of these items that are applicable to their situation. Regardless of the length and complexity of your return, you may find this very helpful in your preparation.

General Taxable Income

___ W-2 Form(s) for Wages, Salaries, and Tips

___ Interest Income Statements: Form 1099-INT & 1099-OID

___ Dividend Income Statements: Form 1099-DIV

___ Sales of Stock, Land, etc.: Form 1099-B

___ Sales of Real Estate: Form 1099-S

___ State Tax Refunds: Form 1099-G

___ Alimony Received or Paid

___ Unemployment Compensation Received

___ Miscellaneous Income: Form 1099-MISC

___ Early Distribution from Retirement Plans: Form 1099-R

Retirement Income and Contributions

___ Retirement Income: Form 1099-R

___ Social Security Income and Railroad Retirement Income: Form SSA-1099

___ Detailed contribution information for your IRA's (Types, amounts, dates, etc.)

Business Income

___ Business Income and Expenses

___ Rental Income and Expenses

___ Farm Income and Expenses

___ Form K-1 Income from Partnerships, Trusts, and S-Corporations

___ Tax Deductible Miles Traveled for Business Purposes

Tax Credits Checklist

___ Child Care Provider Address, I.D. Number and Amounts Paid

___ Adoption Expense Information

___ Foreign Taxes paid

___ First Time Home Buyer Tax Credit

Expense and Tax Deduction Checklist

___ Medical Expenses for the Family

___ Medical Insurance Paid Form 1095-A, B, or C (If not available, bring Health Ins Card, and a copy of a pay stub from taxable year)

___ Prescription Medicines and Drugs

___ Doctor and Dentist Payments

___ Hospital and Nurse Payments

___ Tax Deductible Miles Traveled for Medical Purposes

___ Home Mortgage Interest from Form 1098

___ Home Second Mortgage Interest Paid

___ Real Estate Taxes Paid

___ State Taxes Paid with Last Year's Return (if itemized)

___ Personal Property Taxes Paid

___ Charitable Cash Contributions (Make sure that they are properly documented)

___ Fair Market Value of Non-cash Contributions to Charities

___ Unreimbursed Expenses Related to Volunteer Work

___ Miles Traveled for Volunteer Purposes (Make sure that they are properly documented)

___ Casualty and Theft Losses

___ Amount Paid to Professional Preparer Last Year

___ Unreimbursed Expenses Related to Your Job

___ Miles Traveled Related to Your Job (Make sure that they are properly documented)

___ Union and Professional Dues

___ Investment Expenses

___ Job-hunting Expenses

___ IRA Contributions

___ Education Expenses 1098-T

___ Moving Expenses

___ Last Year's Tax Preparation Fee

Tax Estimate Payments Checklist

___ Estimated Tax Payments Made with ES Vouchers

___ Last Year's Tax Return Overpayment Applied to This Year

___ Off Highway Fuel Taxes Paid

General Information

___ Photo I.D. for You and Your Spouse

___ Copy of Last Year's Tax Return

___ Social Security Numbers and Dates of Birth for You and Your Spouse

___ Educational Expenses for You and Your Spouse

___ Dependents' Names, Dates of Birth, and Social Security Numbers

___ Dependents' Post High School Educational Expenses

___ Child Care Expenses for Each Dependent

___ Prior Year Adjusted Gross Income (AGI) & Personal Identification Number (PIN) - how to find last year's adjusted gross income (AGI)

___ Routing Transmit Number (RTN) (For direct deposit/debit purposes)

___ Bank Account Number (BAN) (For direct deposit/debit purposes)

NOTE – This list is not all-inclusive. There are a number of other documents that you may receive for tax purposes that are printed on an applicable and acceptable form. Some of them do not. In order to take proper advantage of these, you will need to provide adequate documentation. If you need help gathering, sorting, and entering information, now is the time to seek help from a professional. We can provide guidance and templates to make the process more efficient, more effective, and less stressful. This can also save you additional time and expense.

-Michael Hermanson, CPA | CGMA

Smart Money Tips for the Class of 2014

Smart Money Tips for the Class of 2014

Whether you are a college grad or a high school grad, here are some helpful suggestions as you embark on your new endeavors.

For college grads -- live like you are still in college. Your first (or new job) may be exciting, especially if you are making more money. Do not let it burn a hole in your pocket. You may have to move so your best bet is to get yourself established in your new city, first. For the high school grads -- don’t live like you are living with your parents. Take control of your finances, whether you’re going on to school or getting a job.

The best way to take control is to create a budget and stick to it. What monies are coming in? What monies are going out? What is your discretionary income? You may need to make sacrifices to your “Want” and “Nice to have” lists. Information is key. The more information you have, the better the decisions YOU CAN make. There are no guarantees that you won’t spend money on every shiny object you see. Patience is indeed a virtue when you are heading out on you own.

Tax Return - Deductions for job hunting and moving expenses may not apply to you, if this is your first job in your field. However, to be sure, you should ask an accountant. At a minimum, you should review Publication 529, from the IRS. These two examples fall under Miscellaneous Deductions. This publication can be found at www.irs.gov.

KEEP YOUR RECEIPTS -- either as a hardcopy or electronically. For school, you may be able to take advantage of educational tax benefits. You may also have expenses for your work. I think that it is best, though, to keep all of your receipts. This includes cash receipts. If, for no other reason, you can use these receipts to at least analyze your spending habits. If you need to cut back, this is a great way to look at your options.

Put money away. If you are like most people, you believe that you will live for many years. Will you have the resources put away so that you are able retire at some point in the future? If not, do you plan on working until you just can’t work anymore? If you start saving early on, you won’t have to rush at the end to fill your coffers. Your company’s 401K may be your best option to begin with, especially if they match or exceed your contributions. A Roth IRA, a savings account, and a certificate of deposit are also good options. The two latter options, will currently not provide the greatest returns. If you have excess funds and want to invest, a Certified Financial Planner is a good resource for that arena.

Manage your W-4 Form. When you begin your new job, make sure that you do not take too many allowances. I have seen people mark down “Single” with 10 allowances. That’s because they want more monies in their pocket now. Then, the following year, they end up owing taxes and can’t understand why. Planning can make a world of difference. Many ”single” people can usually mark down “zero” allowances and play it safe, but very situation is different, so you may want to consult with tax professional to find out what is best for your situation.

Get insurance, especially health insurance. Some of you may still be covered under your parents’ policy and that is fine. If that window is of opportunity is gone or will be gone soon, you need to consider getting insurance through another source. The first obvious source is through your employer. You can also get life, dental, vision, LTD, and other insurances. If it is available, it would be best to take it. If this is not possible and you cannot take advantage of a spouse’s insurance, there is always the Healthcare Exchange. Having insurance protects your financial future.

Do not look at these as unnecessary controls, but as good, long-term habits that will help you. Be excited about graduating! Be excited about getting out on your own! Remember that the fledgling bird may fall out the nest on the first attempt, but when it has its feathers in place, it can soar.

-Michael Hermanson, CPA | CGMA

Should NCAA College Athletes Get Paid?

Let's start with some background on colleges.

College can be defined as “an institution of higher education created to educate and grant degrees; often a part of a university.” To this end, on November 8, 1965, as part of President Lyndon Johnson’s Great Society domestic agenda, LBJ signed the Higher Education Act of 1965 (HEA). The law was intended to “strengthen the educational resources of our colleges and universities and to provide financial assistance for students in post secondary and higher education.” The impetus for the HEA was LBJ’s desire to use education as a tool for economic growth and development. It increased federal money given to universities, created scholarships, gave low-interest loans for students, and established a National Teachers Corps. In other words, it was designed to make higher education more accessible to populations of persons who were previously unable to attend these educational institutions because of economic circumstances.

Furthermore, the Education Amendments of 1972 included Title IX which states (in part) that: “No person in the United States shall, on the basis of sex, be excluded from participation in, be denied the benefits of, or be subjected to discrimination under any education program or activity receiving federal financial assistance.” Today, when we hear about Title IX, it is synonymous with equality in athletics. The legislation was not written to remedy inequality in this area.

Now we fast forward to the recent court ruling striking down NCAA regulations that prohibit student athletes from getting anything other than scholarships and the cost of attendance at schools. The NCAA can no longer stop players from selling the rights to their names, images, and likenesses. This ruling is specific to FBS football players and Division I basketball players. The judge also said that the body that governs college athletics could set a cap on the money paid to athletes, as long as it allows at least $5,000 per athlete per year of competition. This sets a floor but not a ceiling. Larger colleges could pay larger amounts if they wanted to and potentially “buy” championships. This would potentially put smaller schools at a disadvantage for bringing in student-athletes. Potentially, the best players could:

- Get a free ride through college

- Earn at least $5,000/year of completed season ($20,000 pay-out post-graduation)

- Earn money from selling the rights to their names, images, and likeness

If I am looking at a college and these three items are present, wouldn’t this behoove me to go to this college?

“This week, the NCAA's board voted to allow the five wealthiest conferences in the country to set their own rules, paving the way for the 65 schools in those conferences to potentially offer richer scholarships and health benefits to players. The NCAA also spoke of the education provided to athletes as payment for their services and said the college model has functioned well for more than a century. They contended that paying players would make college sports less popular and could force schools to cut other programs funded by the hundreds of millions of dollars taken in by big-time athletics.” So...is the NCAA saying that they are going to sacrifice academic students for the “greater athletic good?” How much is this going to cost them to pay the athletes? How much money is the athletic program bringing in? Is the program even making any money? Former athletes will not be paid. In fact, this decision will not affect any prospective recruits before July 1, 2016. This means that the college would not have to start paying out until 2020, potentially.

This ruling comes after a five-year battle. Former UCLA basketball star Ed O’Bannon and 19 others brought forward the lawsuit that challenged the NCAA’s regulation of college athletics. It is being called a “game changer.” O'Bannon, who was MVP of the 1995 UCLA national championship basketball team, said he signed on as lead plaintiff after seeing his image in a video game authorized by the NCAA that he was not paid for. There is, however, a twist to this story. O’Bannon was quoted as saying that "I was an athlete masquerading as a student. I was there strictly to play basketball. I did basically the minimum to make sure I kept my eligibility academically so I could continue to play." Several players testified during the trial that they viewed playing sports as their main occupation in college, saying the many hours they had to devote to the sport made it difficult — if not impossible — to function like regular students.

And now we find ourselves in a quandary...

Do people go to college for academics…or athletics? Most people used to think that it was academics and those involved in sports were referred to as student-athletes. As I was looking at the references to student-athlete, I also found athlete-student. This should not be surprising. It has been going on for years. Once colleges started offering athletic scholarships, the rules of engagement changed. As far as I can see tell, the scholarships began around 1892 at the University of Chicago. It appears as though there is a “tradition” going on here. I can remember needing to do well in my classes in order to maintain my athletic eligibility. Fortunately for me, I had no problems with this. What about the athletes that are barely getting by? What about the coaches and/or instructors that give these athletes the minimum grade to fulfill their eligibility? Shouldn’t they bare some of the responsibility? If they do not go on to play professionally, have they earned a degree that will help them? Are they prepared? Did they outlive their usefulness and are now no being dropped along the side of the road? Did they realize the full impact of what being an athlete-student encompassed? This could come down to a he said/she said situation.

And this brings about even more questions and thoughts...

Since independent contractors have some independence and autonomy, I believe that these athletes will be considered employees with deferred compensation. Will the colleges be paying all of the benefits to the players, which are already afforded to the existing college employees? Will the college’s insurance cover these athletes since they are now considered a high-risk group? Since the athlete is now gainfully employed, would they no longer be covered under their parent’s health insurance? If the athlete is injured, will they receive disability as an employee? Will the schools carry life insurance on these players? Are the players aware that this is taxable income? Will the schools withhold income taxes when payments are earned? When distributed? Will the monies set aside for the players be invested and earn taxable interest? Will this affect the contract offers if they go on to play professionally? In other words, they have already been paid for playing for four years as a “professional.” Will the professional leagues have to increase the starting pay because of the non-amateur status? Will the ruling effect the years of eligibility in college? Can someone play for seven years or longer in college? There are plenty of potential ramifications.

I think that this story is much bigger than what this ruling states and more information will come out, in time. It is also much bigger that one blog post can cover. The bottom line is that athletics are big business. They fund a lot of what goes on at the bigger colleges/universities. What is going to happen with this ruling? It is being appealed by the NCAA. Will these collateral stories coming out cause more investigations and more damage control? I am sure that they will. We will have to keep an eye on this to see how it will unfold. At the very least, there is a lot of food for thought. I was a player and a coach. This is close to me. We welcome comments in order to continue the dialogue.

-Michael Hermanson, CPA | CGMA

FATCA Facts

A short run-through regarding the

Foreign Account Tax Compliance Act

(FATCA)

The United State levies income taxes on its citizens, regardless of residency. This requires Americans that live abroad to pay U.S. taxes on foreign income. Generally, U.S. persons are generally required to report and pay taxes on income from ALL source, under U.S. tax law. To help to this end, FATCA was signed into law.

FATCA stands for Foreign Account Tax Compliance Act. It is a Unites States statute, which was enacted by Congress, and is part of the Hiring Incentives to Restore Employment (HIRE) Act of 2010. FATCA requires persons of the United States, including those individuals living outside of the United States, to report ALL of their financial accounts held outside of the United States. It also requires foreign financial institutions to report on their American clients, to the Internal Revenue Service (IRS). FATCA is designed to make it more difficult for US taxpayers to conceal/hide assets held in offshore accounts and shell companies and helps the IRS to recoup federal tax revenues. Taxpayer identification numbers and source withholding are used to enforce foreign tax compliance. The IRS previously instituted the Qualified Intermediary program. It required “participating” foreign financial institutions to maintain records for the U.S. or foreign status of their account holders and to report income and withhold taxes. Compliance was poor. Self-reporting of foreign financial assets was also found to be ineffective.

The first provision of FATCA requires foreign financial institutions, such as banks, to enter into an agreement with the IRS to identify their U.S. account holders and disclose the account holders’ names, TIN’s, addresses, account balances, receipts, and withdrawals. U.S. payers making payments to non-compliant foreign financial institutions are required to withhold 30% of the gross receipts.

The second provision of FATCA is U.S. persons owning foreign accounts or other specified financials assets must report them on the Form 8938, Statement of Specified Foreign Financial Assets. This form is filed along with the person’s U.S. tax returns. The reporting thresholds are:

TAXPAYERS LIVING INSIDE THE UNITED STATES

Unmarried taxpayers – the total value of your specified foreign financial assets is more than $50,000 USD on the last day of the tax year or more than $75,000 at any time during the tax year.

Married taxpayer filing a joint income tax return - the total value of your specified foreign financial assets is more than $100,000 USD on the last day of the tax year or more than $150,000 at any time during the tax year.

Married taxpayer filing separate income tax return - the total value of your specified foreign financial assets is more than $50,000 USD on the last day of the tax year or more than $75,000 at any time during the tax year.

TAXPAYERS LIVING OUTSIDE THE UNITED STATES

Unmarried taxpayers – the total value of your specified foreign financial assets is more than $200,000 USD on the last day of the tax year or more than $300,000 at any time during the tax year.

Married taxpayer filing a joint income tax return - the total value of your specified foreign financial assets is more than $400,000 USD on the last day of the tax year or more than $600,000 at any time during the tax year.

Married taxpayer filing separate income tax return - the total value of your specified foreign financial assets is more than $200,000 USD on the last day of the tax year or more than $300,000 at any time during the tax year.

Account holders would be subject to a 40% penalty on understatements of income in an undisclosed foreign financial asset. Understatements of greater than 25% of gross income are subject to an extended statute of limitations period of six years.

The third provision of FATCA is that it closes the tax loophole that foreign investors had used to avoid paying taxes on U.S. dividends by converting them into “dividend equivalents” through the use of swap contracts.

With all of this said, FATCA is surrounded with controversy. It is said that the cost to implement outweighs the benefit of the additional revenue. The complexity of the legislation has already pushed the implementation back twice. Is the IRS ready to handle the millions of new “complicated” filings each year? The U.S. is not funding the foreign governments that would be responsible for collecting these taxes and sending them to the U.S. How will this effect foreign relations? Will this provide an incentive for foreign financial institutions to no longer invest in the U.S.? I guess that only time will tell.

-Michael Hermanson, CPA | CGMA

Sources:

Irs.gov

Wikipedia.com

Thomsonreuters.com

AICPA.org

Client Review - 2Rivers Bicycle & Outdoor

I love the great outdoors! The fresh air, the sites, the sounds, and the bicycles! Yep, the bicycles. I see them all over when finding the time to hike with the malamutes in the great state of Wisconsin. I frequently enjoy and take advantage of the numerous hiking, biking, and multi-use recreational trails in our area. And when I do, I think of John at 2Rivers Bicycle & Outdoor.

John is a smart guy - a smart business and financial guy. He provides over the top customer service and cares only about providing you with the best experience -- whether you're biking, running, kayaking, or snowshoeing. And he's smart enough to know that when you want to start your own business, you need to ask for help - because even a professional from a successful career in financial planning, software development, and solutions analysis may not have all of the answers when it comes to starting his own bicycle retail business. Writing requirements for a point of sale system and working for financial firm is a bit different from driving your own business, putting your OWN skin in the game, and rolling the dice. He planned, he sought advice, and knew when to ask the experts at FLEX for that CFO Advisory, Accounting, and Strategic Planning, to make sure he truly was on the right path. Nice that FLEX could help him to avoid the flats and unexpected roadblocks along the way.

I am proud of what John has accomplished both on his own and with our advice. From simple suggestions like "Bicycles are great, but what about off season? Ever consider those triathletes in the area that maybe want to work with a smaller specialty store without having to travel to Milwaukee or Madison to find that service? That area upstairs would make a fabulous spin cycle area. Hey, where are the snowshoes and skijoring gear, why aren’t you offering winter sports?"

It was these exact questions that led to answers and new product channels. Questions that opened up expansion opportunities and new business partnerships. Opening up the door for new and continuous growth in 2014. Congrats to John and his team on another successful year! We can't wait to see where this last round of advice lands you.

Oh, and John… I am still waiting for that bicycle trike design that can handle braking against a 145lb Alaskan Malamute that currently pulls 2.5 tons. Those Fat Bikes look promising, but I still think my naughty red dog will break it like a toy bike.

-Michael Hermanson, CPA | CGMA

Best Value For Your Money

As I've been talking with people, I keep hearing the same thing. Value. I want value for my money. They need to meet Michael and the FLEX SWOT* accounting team.

Am I biased? No. They have proven over and over again that they have one goal in mind. To provide the best value and return for those who use their services. I consider them the best offensive line in the business.

Tax season is here, and I keep seeing ads touting using software to do your taxes - that that will give you the best and easiest return. I make a living testing and breaking software and showing how inadequate it can be. Verifying that the software matches current medical, financial, insurance, and manufacturing standards. Ask me if I trust software. I don't. I trust the human interpretation of the software after it’s been verified against standards and triple checked. You need BOTH. Because we all know that offense, not just defense, wins the game.

A few years back I ran a quality check against using software vs. using a human. After testing Taxcut, H&R Block, and Turbo Tax individual and small business software packages as a possible solution for doing taxes for my business, and then having the same review done by three other accounting firms, I discovered a simple point. Human won, hands down. The software missed the nuances of the use case scenarios that I threw against them. The human interaction caught the refunds that the software would not allow, but that tax law allowed. How did I know? The Accounting Human confirmed that for me, and we ran side-by-side comparative analysis. Then I took it a step forward. Who is better - a CPA or a tax preparer? Final analysis, the CPA. Why? QUALITY. The CPA went through years of education and had experience at the corporate and small business level. They stay up on changing laws. More importantly, I found that cops make the best CPAs. Why? They know the difference between bending and staying purely black and white. Numbers and data don't lie, but having the stones to stick to the ethical interpretation of whether it was better for the client or not - that is who I want doing my taxes. Not software that is buggy or a firm that says, "You can do this...but maybe not next year." I'm willing to pay for the quality and assurance guarantee - that what I am getting for a return is honestly what I am owed. I want guidance as an individual and a business to understand how my financial decisions impact on the long haul view of life. We believed in this so much that we added accounting to FLEX -- because we wanted that constant control and oversight on all aspects of what we do here. Internal audit at all levels.

I want Michael and his SWOT team. I want the guy who knows how to stand up for what is right. I want the CPA expert witness for a Forensic Accounting case that makes the lawyer sweat because he knows he is in trouble because the analysis provided by the FLEX SWOT accounting team is honest, accurate, and ethical. That Michael, as a former police officer, won't waver knowing he and his team have the mountain of research to validate their opinion.

*A SWOT panel is a team of experts who can identify the Strengths/Weaknesses/Opportunities/Threats to a project/initiative.

-Shannan De Witt, FLEX CEO

Client Spotlight - Rockin Arrow Ranch

Client Spotlight - Whatever It Takes

Sometimes I get struck by an image, and the power behind it. That happened when I saw this picture Dana Keller Owner of http://www.rockinarrowranch.com/ posted on her FaceBook page. What an amazing example of perseverance in the face of adversity, and truly keeping her eye on not only the business target, but her life target.

A few years back, Dana approached FLEX to help her with her dream of running her own Horse Training and Boarding center. We sat down, discussed options, and laid out several short and long term goals. The timing was perfect, her location key, and she jumped in. We were excited to see her successful and doing the things she loved. A little business planning, accounting management, market review, and she was up and running.

But then, life happens. Dana was faced with the option of continuing her business full time or having to go back to work for someone else full time. She found herself as the only bread winner, after her husband was hit hard by the down turning economy. Again, we discussed options and goals. Do you go back to the work force, ‘saddle’ the training business, and make sure the family stays on track? Is the risk worth the feeling of security? Can you do both? Being the strong individual that she is, she made the leap to go back to doing of all things – construction work. Working two full-time jobs (her business and construction) and continuing to volunteer for 4-H and local shooting groups.

Then I received another phone call, which kind of tapped back into my Athletic Trainer and football coaching days. “What do you think of me running marathons?” A few months later we are standing at a triathlon and I am cheering her on! With the help of http://2riversbicycle.com/ I negotiated a sweet deal for her first Tri-bike. Training helped her stay focused and grounded when the day-to-day got to be a bit overwhelming and a stress release mechanism was needed.

Then, as with life, it changes yet again.

Again I received a call, but this time, it was for another shift in her life. We discussed the options of new roles that she would be taking on and the opportunities they would present. Key opportunities would be more time for the horses, for competing, and additional 1:1 training for shooting clients. Together we discussed the pros and cons as well as the impacts to both the ‘now’ and the ‘future’. There is more than a little risk with this new adventure – but knowing Dana, she will take it in stride and stay the course.

I don’t know of many firms which take this kind of a hands on approach over the years, but this is what makes us unique. When she first started out many years ago, she received lots of information – but not really the ‘how to do it’. Our backgrounds allow us to look at more than just the business, but the individual as well, and work with them to achieve their dreams – even when the dream turns into a nightmare.

So, when you’re feeling like the world is against you both professionally and in life, think of this picture of perseverance. Life happens, but no matter how many times that target shifts – be confident that eventually you will successfully hit it.

-Shannan De Witt, FLEX CEO

Keep the Child Care Credit in Mind for Summer

If you are a working parent or look for work this summer, you may need to pay for the care of your child or children. These expenses may qualify for a tax credit that can reduce your federal income taxes. The Child and Dependent Care Tax Credit is available not only while school’s out for summer, but also throughout the year. Here are eight key points the IRS wants you to know about this credit.

1. You must pay for care so you – and your spouse if filing jointly – can work or actively look for work. Your spouse meets this test during any month they are full-time student, or physically or mentally incapable of self-care.

2. You must have earned income. Earned income includes earnings such as wages and self-employment. If you are married filing jointly, your spouse must also have earned income. There is an exception to this rule for a spouse who is full-time student or who is physically or mentally incapable of self-care.

3. You must pay for the care of one or more qualifying persons. Qualifying children under age 13 who you claim as a dependent meet this test. Your spouse or dependent who lived with you for more than half the year may meet this test if they are physically or mentally incapable of self-care.

4. You may qualify for the credit whether you pay for care at home, at a daycare facility outside the home or at a day camp. If you pay for care in your home, you may be a household employer. For more information, see Publication 926, Household Employer's Tax Guide.

5. The credit is a percentage of the qualified expenses you pay for the care of a qualifying person. It can be up to 35 percent of your expenses, depending on your income.

6. You may use up to $3,000 of the unreimbursed expenses you pay in a year for one qualifying person or $6,000 for two or more qualifying persons.

7. Expenses for overnight camps or summer school tutoring do not qualify. You cannot include the cost of care provided by your spouse or a person you can claim as your dependent. If you get dependent care benefits from your employer, special rules apply.

8. Keep your receipts and records to use when you file your 2013 tax return next year. Make sure to note the name, address and Social Security number or employer identification number of the care provider. You must report this information when you claim the credit on your return.

-Michael Hermanson, CPA | CGMA

Team Vs. Me

Team vs. Me – An Observation

Part of the Naughty Red Dog Series

“Teamwork is what the Green Bay Packers were all about. They didn't do it for individual glory. They did it because they loved one another.”

Vince Lombardi

As I watched the Monday Night Football game between Dallas and Chicago last night, I thought about this Vince Lombardi quote. It wasn’t just this game, but I've noticed this in recent years. You see a number of players focusing on their own highlight reel as opposed to working as a unit. For example:

- Observing more illegal and sometimes very dangerous hits

- Trying to strip the ball instead of using sound, fundamental tackling techniques

- Standing around watching others tackle

- Cut blocking or holding instead of engaging the opponent with technique, power, and/or finesse

- Unnecessary selfish personal foul penalties

These activities have a negative effect on the outcome for the team. That is where there is a correlation between football and business.

Football was designed to be one of the most team-oriented sports. You have eleven players on the field all working towards a common goal, whether on Offense, Defense, or Special Teams. This covers both on the field and off. Immense effort goes into building a team. What is your product or service? How will you recruit? How much will they be paid? What kind of benefits will you offer? Who will be your head coach/CEO? Who will be your coordinators/Executives be? Who will your assistant coaches/managers be? Who will your players/employees be? Where will your stadium/business be located? What offenses, defenses, and special teams/business model will you run? What is you game plan/business plan? Who will your fans/customers be?

These are all questions that need to be answered, but we have seen a great deal of inequity in the sports and business arenas. Does that QB/Executive deserve to be paid $10M/year plus bonuses? How many other players/employees will have their pay decreased because someone else demands more compensation? Will you sacrifice the many to keep the one? A real-life example of this is a CEO who was making an annual salary base of $10M. As they lost a couple of contracts, the CEO decided that they still deserved a raise. In order to make that happen, 30+ positions were eliminated to allow for the raise. The pay for those positions ranged for $35K to $50K/year. Where did teamwork go?

This lends itself to the next obvious question. How do you get the competitive edge? Do you believe that you can buy a championship/success? Are you willing to abide by the rules and guidelines that have been set forth? Or is okay for you to hurt others for your own gains? Bountygate/Enron? Do you want to be successful because you have a sound program/business plan or are you willing to sacrifice others for your own advancement? We should try to hold ourselves to a higher standard. Maybe I am looking at this from a more “black and white” or a “pie in the sky” viewpoint. Ethics, values, and integrity. If we do not hold to these, what do we have?

-Michael Hermanson, CPA | CGMA

Safety Tips For Protecting Records From Both Natural and Man-made Disasters

Protecting Your Records from both Natural and Man-made Disasters

No matter where you live, disaster can strike at any time. They can hit you at home, or at work. Whether it is a tornado, hurricane, flooding, ice problems, fire, smoke, vandalism, theft, or other destruction, there are some simple steps that you can take to help make your road to recovery a little bit easier. I encourage you to be proactive, rather than reactive.

1. Document Your Valuables: Create a list of you assets and include your basis in the asset. Then take pictures, videotape, or capture the images digitally. This documentation may help to prove the value of your lost items for insurance claims or for casualty loos deductions. Again, this can be done for your home or your place of business.

2. Obtain Copies of Records that were Lost or Destroyed: These can be tax returns, bank statements, insurance policies, and the like. For tax returns, you can ask for copies from you tax preparer or from the IRS. If you prepare your own return and need a copy, you can go to IRS.gov and get Form 4506 – Copy of Tax Return. If you just need information from your return, you can order a transcript online at irs.gov. For bank statements, most bank provide them electronically. For insurance policies, your insurance agent will be able to assist with both your claim(s) and your records requests(s).

3. Have an Emergency Plan: You should have a plan in place for your home and for your business, in the case of an emergency or disaster. If you do not have one, you should take the time to create one. This will help keep you safe, as well as helping you recover faster, if your information is lost. You should review your plan on an annual basis, at the least. You should update as needed and as your situation changes.

4. Back up Your Records Electronically: Keep extra copies of important records in an electronic format and keep them in a safe place, away from where you store the originals. You can scan in hard copies of your records. You should also back up your laptop, base system, or other device.

The back-up(s) will consist of external hard drives, CD’s, and DVD’s. Preferably, you should keep your electronic records/back-up(s) at an offsite location. Some people will use a safety deposit box at their bank. You should back up your systems on a regular basis. A schedule would help keep you on task.

5. The IRS Can Help: For those individuals who do not have a plan in place and need help with tax issues, the IRS has a Disaster Hotline to help people with tax issues after a disaster. Call the IRS at 1-866-562-5227 to speak with a specialist trained to handle disaster-related tax issues. In the event of a disaster, the IRS stands ready to help. Visit IRS.gov to get more information about IRS disaster assistance. Click on the “Disaster Relief” link in the lower left corner of the home page.

-Michael Hermanson, CPA | CGMA

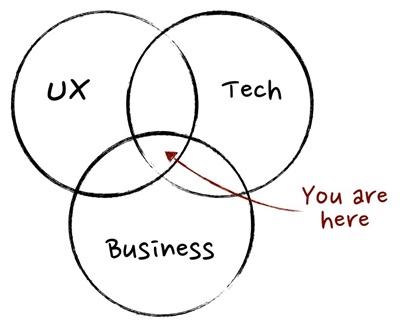

Project Management

(*Image copyright mindtheproduct.com.)

What is a Product Manager?

Wikipedia says:

Product management is an organizational lifecycle function within a company dealing with the planning, forecasting, or marketing of a product or products at all stages of the product lifecycle.

What does that mean? Essentially it means defining the vision of a product, setting up a roadmap to get there, working with stakeholders to keep the development on track and on time (usually working with a Project Manager) and planning for the next iteration of the product or the sunset of it and the next new product to take its place.

First a PdM needs to work with the executive staff and see what is wanted. What do they have, where do they want to go with it. Maybe they don't know. Maybe they have a basic 'executive overview' vision of what they want to make/ do. A PdM's job is to take that kernel and do some research, a lot of it really. Research on the product, the market, the customers. Is this a road already travelled? Is this a new innovation, going where no one has gone before?

For existing products, like a mobile app for gathering stock quotes, or an aggregate news reader, or a video game…there are others out there already. What did they do? What does the market for those products look like? What are they selling it for? How much are they making it for? There are tons of questions to ask because those are the questions you need to answer in order to crystalize that vision in to a product.

For new products, that gets a lot harder. You often don't know the questions, but you go hunting for them anyhow. How do we get from Point A (an idea) to Point B (a viable product)?

Functionally as a PdM I'd assemble a basic, 'executive overview' for the top levels of management. A feasibility study. Basic numbers on the market and customers, and a list of all the applicable touchpoints as we know it at the time. From this we can get an idea of the cost:

"We'll need one C+ coder, a .Net guy, a couple QA guys, a graphic designer/ web guy, a PM and a PdM. It'll take approximately X weeks to do the initial code, Y weeks to QA, and Z to do bug fixes before we can release the first iteration of the product. That costs ~250k from start to finish for Phase One."

From there, once we have approval I'd work with the stakeholders to nail down a requirements document, with user stories so the developers can get to work. The requirements/ user stories are for the QA team too, that's what they test to. Keep this loose if at all possible. More focus on user stories, less focus on the requirements verbiage. Work with stakeholders on mockups.

A product manager works with a lot of groups. Every team that has a hand in the product usually will know the Product Manager. The PdM attends a lot of meetings, standups, and chats with team members in the hallways. He's the guy who knows the VISION. I can't express how important it is to develop relationships with all the teams involved. Ideally whenever they have questions, they'd loop you in (instead of having varied teams going off on their own based on assumptions).

In past lives we've had a dedicated team who handled marketing. The PdM didn't handle marketing, but worked closely with them. I know in some organizations the PdM wears the marketing hat more often.

Also, I'm used to having a Project Manager to work with versus doing the PM work as well. The PM and PdM work very closely. Think of the PdM as the strategist and the PM as the tactician. The PdM identifies all the touchpoints for a product to get developed and has the vision, but it's the Project Manager who really makes up the schedule and lines up all the work to get done in nice neat little pipelines.

To be fair, an Agile approach tends to work best for Product Management versus Waterfall as the latter tends to be very slow moving, inflexible and Product Lifecycles tend to be rapidly-changing environments, most especially in software. The market changes so fast that if we are required to go back to a solid Product Requirements Document for every change, we'll be waiting a lifetime for the docs to be edited, and development to be re-started, we'll end up chasing our tails in a mire of bureaucratic BS when we should be getting a product out the door and revise in the next iteration.

One of the problems with developing any product is that the marketplace and customer landscape is constantly changing. Often by the time a product hits the market, things have changed and the product isn't as relevant as it could have been, or as it was when development first started.

Case in point, the MMORPG market. When Star Wars: The Old Republic was started the norm was for games to have subscriptions. By the time the game was released all the top-tier games were Free To Play, with Microtransactions AND a subscription for premium play. Needless to say when the market has so many games already, free to play, it's a hard sell to get people to pay up front for your game, even Star Wars. Subscription numbers never hit their marks and SWTOR went Free To Play w/ Microtransactions within a year. In the process the company took a massive hit and reduced their staffing by over half.

So as a product manager we need to keep a constant eye on the market. It's a moving target.

Another part of being a PdM is to look forward. It's not just about getting a product to market but to keeping it fresh, valid, relevant in today's market. Technology changes. Today it is an iPhone 5 but the iPhone 6 will be out shortly, a new OS, a new gadget, a new way of doing things. Is your product going to be ready for the Xbox One/ PS4?

Can your existing product reasonably compete? Is it time to sunset it and develop a new model?

It's a never-ending cycle of questions we ask, that we need to stay on top of.

So what is a Product Manager?

It's a person who asks a lot of questions and gets a lot of answers about the product you want to make and the environment/ market you want to release it in. They find all the moving parts and identify them and build relationships with all stakeholders. They are part of a team that helps get your idea in to the market and helps keep it there, working for you.

-Shannan De Witt, FLEX CEO

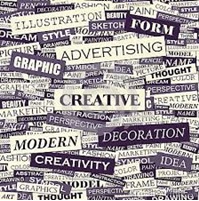

Whitewater Workshop

The FLEX Consulting team had the privilege of participating in the Creative Entrepreneurship workshop held at the University of Wisconsin Whitewater in their new Innovation Center last Friday. It focused on the “Creative Enterprise”, which is any organization or sole proprietor providing or distributing goods or services in which the aesthetic, intellectual, and emotional engagement of the consumer gives the product value in the marketplace. Attendees included photographers, graphic artists, musicians, fine artists, a yoga instructor, and a theatre company start up. The panel of experts included a number of successful owners of “Creative” businesses from the area, including Roy Elkins, the CEO and owner of broadjam and Ellen Waldmer, owner of Rock River Gallery and Coffeehouse. We enjoyed catching up with Roy and chatting about changing times and economic impacts to both of our businesses. Roy brought a unique view to the seminar, as his growth and product line has changed over the years to accommodate an up and down market. Ellen Waldmer shared insight with the group, noting that she knew she could never just own an art gallery type of business. Another revenue generating venue that would “draw” people in and compliment the art gallery was needed. Hence the combining of coffeehouse and gallery into one. Her previous corporate experience helped her identify the need to create a profitable business, and she was business savvy enough to know that there were parts of the operational side that she needed help with – accounting – even though her previous experience was in finance.